Road freight rates edge up — narrowing the gap with rail

The latest benchmark shows that both contract and spot road freight rates increased to around 134 index points, converging for the first time in several quarters. Contract prices are up 1.7 points QoQ, spot rates mirror the same rise.

For rail freight companies, these numbers matter: higher trucking costs often increase the competitiveness of intermodal and rail–road combined transport, especially on long-distance corridors.

UIRR members monitor trucking dynamics closely, because road prices are one of the strongest drivers behind modal shifts. In previous years, rising diesel, tolls and labour shortages were among the factors pushing some cargo from road to rail. In Q3 2025, structural road-cost pressures continue.

Volumes remain weak — but recovery is possible in 2026

European road freight volumes are still below 2024 levels, especially on major industrial lanes such as Germany–Poland or Germany–France. Household consumption remains cautious, and industrial production in several economies — especially Germany — is still volatile.

Despite that, inflation is stabilising near 2.4%, and analysts expect road volumes to rebound in 2026 as industry sentiment gradually improves. For rail operators, this signals that competition from trucking could strengthen again next year unless rail service quality and pricing remain attractive.

Cost pressures on road haulage remain high

The report highlights several structural cost factors:

- Tolls rising across Europe — Romania +17.8%, Bulgaria +7.7%, Slovakia +40.9%.

- Further increases coming in 2026: Austria +7.7%, Flanders +20%, and the Netherlands switching to distance-based charging.

- Driver shortages remain severe, with 11.2% of positions vacant across Europe.

- Fuel prices stabilise, but HVO and CNG remain volatile.

Taken together, these factors suggest that road freight prices will likely stay elevated, which could strengthen the business case for combined transport and long-distance rail freight.

Southern Europe outperforms — Spanish demand driving up rates

While Germany, France and Italy face slowing domestic and international volumes, Spain is the exception. Strong GDP growth, positive retail sentiment and industrial momentum are pushing domestic and international spot rates higher.

This is relevant for intermodal operators on Iberian corridors: stronger Spanish consumption and manufacturing could increase demand for long-haul combined transport to France, Germany and the Benelux.

Weak economic sentiment keeps spot rates volatile

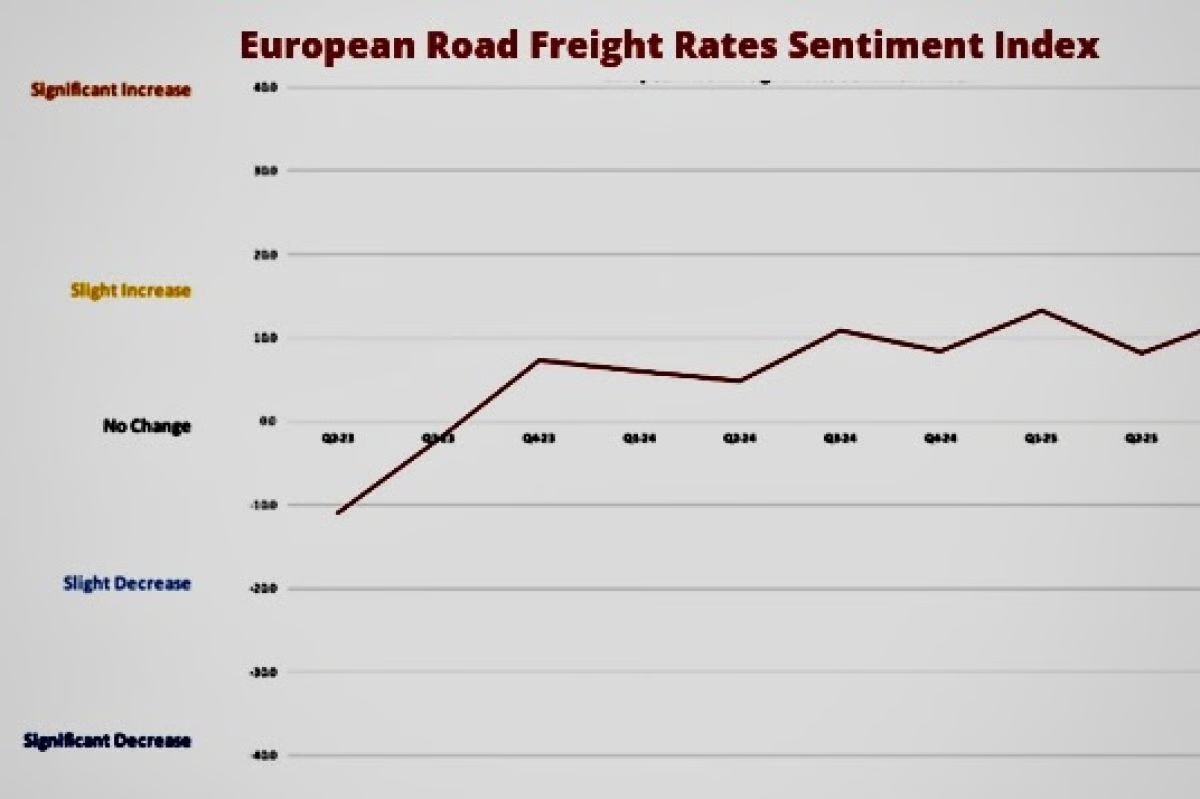

The EU’s Economic Sentiment Indicator remains below its long-term average (94.0), signaling persistent uncertainty. Yet, the European Road Freight Sentiment Index rose to 12.7, indicating that most carriers expect rates to rise slightly in the near term — driven primarily by pre-holiday restocking and strong food retail.

Higher seasonal demand often creates opportunities for rail freight operators to secure additional intermodal volumes where capacity permits.

What it means for rail freight operators

- Road costs rising → better competitiveness for rail:

Growing tolls, wages and operating costs on the road side strengthen rail’s position — especially for cross-border corridors where electrified rail is more cost-efficient.

- Weak industrial output in Germany → lower rail cargo volumes:

The same economic headwinds affecting trucking are also impacting rail freight, and the slow recovery of German manufacturing continues to limit demand for both modes.

- Driver shortages → structural pressure on road capacity:

Long-term workforce challenges in trucking may shift some cargo toward rail, particularly intermodal flows where rail avoids bottlenecks caused by lack of drivers.

- Iberian growth → intermodal opportunity:

Spain’s strong domestic traction supports increased international volume potential — relevant for operators on the Atlantic and Mediterranean RFC corridors.

Strategic Takeaways

The Q3 2025 road freight benchmark suggests a market slowly stabilising at higher cost levels. For the rail sector, this environment remains strategically favourable: road trucking is getting more expensive, more regulated and more capacity-constrained.

Yet until European industry fully recovers, demand for both rail and road cargo will remain uneven. Rail operators who can offer reliable, price-competitive services — especially in intermodal — stand to benefit most from the gradual tightening of road freight economics.